According to Brad Kelsheimer, the vice president for finance and administration and other staffers at DePauw, the current rate of endowment withdraw is “unsustainable.”

In order to combat this budget shortfall and the issues, the University is also hoping to grow their population of students to help combat issues with the budget. “Growth of the student body is important,” said Kelsheimer. “I say that for a number of reasons, part of that is financial, there’s no question that it’s a utilization, and I think it adds to the experience too.”

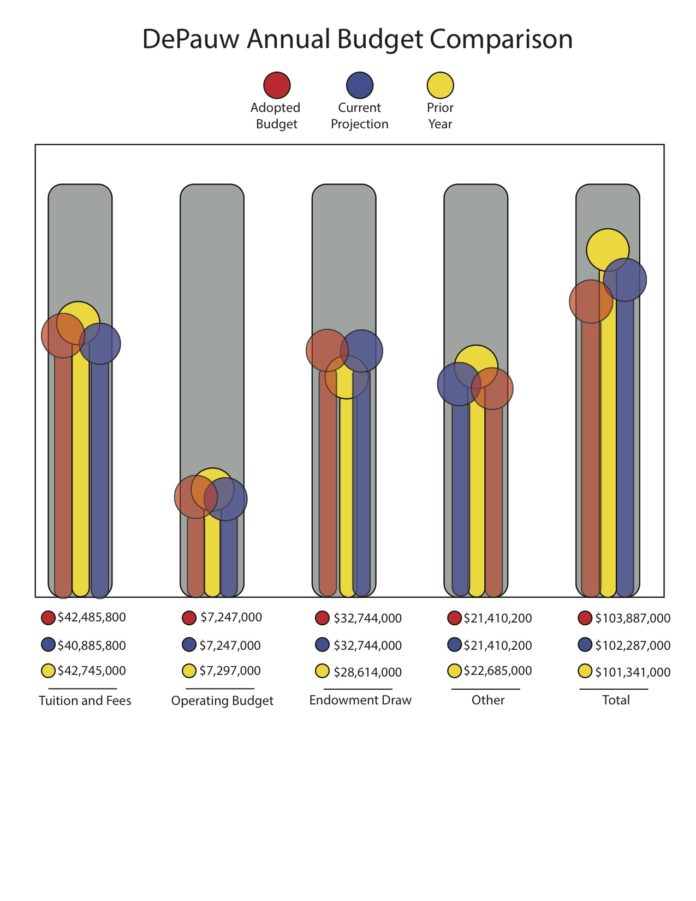

As of Dec. 31, which is the last time the endowment could be measured, it was at $644,601,000. This year, DePauw is drawing $32,744,000 from the endowment, and last year they drew $28,685,000. “The level is fiduciarily irresponsible,” Kelsheimer said.

In order to continue increasing the endowment by five percent annually, DePauw must make an average return of eight percent to compensate for three percent expected inflation. “I happen to think that eight percent is an aggressive number over time, that’s just my opinion,” Kelsheimer said.

However, in order to balance the University’s budget and provide financial aid, the endowment draw is greater than the five percent that it should be. “Over time we’re eroding our purchasing power,” said Kelsheimer. “In my view it’s not a responsible thing for us to be doing.”

The endowment is spread apart into different third party investments which are all managed by Cornerstone Partners, a company in Charlottesville, Virginia, which DePauw has worked with for three years. Cornerstone is a small investment firm which makes its investment in the quality of a company for investment, and do not try to time the market in any way. “I think it [timing the market] is riskier and you tend to converge at the median,” said Kelsheimer. “There are people that are good at that, but it’s tough to find someone who can really project what the global economy will be like.”

Through Cornerstone Partners, 20 percent of the total endowment is invested in domestic public equity, 20 percent is in international public equity, a little less than ten percent is fixed in bonds and cash, five percent in real estate, eight percent is invested in natural resources, and seven and a half percent is liquidity, and the rest are in credit opportunity. Public equity is different projects that are constructed either in the United States or internationally.

The University’s main sources of revenue, in addition to the endowment, are gifts and tuition. While the alumni donations have remained at their usual level, the University gave out $54.4 million in financial aid, and according to Kelsheimer, while not known completely, the financial aid given is estimated to be $57 million for this next year.

Kelsheimer and the DePauw administration seek to provide a balance between the cost of current facilities and a downturn in enrollment. “We have more capacity than we need,” said Kelsheimer. “We either grow from an enrollment perspective or we reduce that capacity.”

While growing the student body, the University will continue its practice of deferred maintenance, which is leaving non-essential construction projects on hold until there is more room in the budget to pay for them. “I’m sure people close to projects were slated to be done feel that,” said Kelsheimer. “We did not defer anything that had safety challenges.”

Annually, the University defers about four to five million dollars of maintenance. This year, they are deferring projects, including a preventative maintenance project on the roof in Olin, sidewalks which are less trafficked, and small projects like painting and cracks in walls. “We’ve deferred more aesthetic things but those still have an impact,” Kelsheimer said.

The University is taking longer to hire new staff members to replace staffers who have left. “We’ve stayed pretty disciplined on the administrative side,” said Kelsheimer. “We’re having to be pretty creative.”

Additionally, President Mark McCoy made an announcement at the last faculty meeting stating that voluntary retirement packages will be offered to staff towards the end of the year.

“I will say that universities do this quite often, as do other organizations, as an opportunity to try to help balance the books,” President McCoy said.

The University emphasizes that theses packages are completely voluntary. “There is no forced retirement, there is no mandatory retirement,” said President McCoy. “This is just an opt-in option.”

However, President McCoy and others are not worried about losing too many valuable employees. “I think that institutional turnover is inevitable; every week somebody comes and goes,” said President McCoy. “Every opportunity gives us a chance to look at what we have done.”

Some members of staff and faculty are worried about the financial applications of these retirement packages.

“The only reason, and I’m talking in generic terms, in general when you see some entity, whether it’s a corporation or a university, and they’re offering a buyout, what’s happened is that their payroll is out of line of what they can tolerate,” said Gary Lemon, professor of economics.

“What you try to do is peel off some of your expenses.”

Lemon emphasized that the results of a staff buyout does not necessarily lead to savings.

“Generically speaking, a buyout doesn’t work that well unless you don’t replace people,” said Lemon. “I don’t know what they’re thinking, but in general if you’ve got people in x, y, z, and we don’t need that many people so we’re going to buyout some of them and we’re going to do the work with fewer people.”

There is no formal approval from the board of trustees required for the voluntary retirement incentives which are only being offered to staff at this point in time. More information will be released about voluntary retirement incentive programs in March to those who are offered the voluntary packages.

The University is currently planning the budget for next year hoping to close the deficit in the budget. “We certainly need to be prepared, knowing the range what type of levers do we have to push in order to make sure we are a financially healthy organization,” said Kelsheimer. “We need to be thinking long-term.”